A lot of you have expressed interest investing in real estate over the years as part of a diversified investment portfolio strategy. However, some of you don’t have the 20%-30% downpayment to get started in rental property investing. Therefore, I’d like to explore the real estate crowdsourcing industry with Fundrise, one of the leaders in the space.

I’ve been a big fan of real estate since college, building a multi-million dollar real estate portfolio in San Francisco and Honolulu, but I’ve only invested in actual physical property since 2003. I’ve always just bought a place to live in for several years and then rented it out.

But with Fundrise, I can now invest with as little as $1,000 – $5,000 in various types of real estate deals across the country with no hassle. In the past, these deals would have required hundreds of thousands of dollars or even millions to access. No more! Now that I’ve sold one of my SF rental houses in 2017, I’ve got over $700,000 in cash waiting to be deployed. Fundrise looks like a promising avenue, especially for investing in non-coastal city real estate where prices are cheaper and net rental yields are much higher.

Fundrise Company Overview 2018

Fundrise is one of the leading real estate crowdsourcing platforms that has raised over $40 million to date. They are based in Washington DC. Here is their profile overview for your review.

Total Equity Funding: $41 million + $16 million from Fundrise members through their “Internet Public Offering” in February, 2017

Headquarters: Washington DC.

Description: Fundrise is the leading online real estate investment crowdfunding platform. Starting in 2012, Fundrise was the first company to take commercial real estate public online and offer true equity ownership in local properties.

Founders: Brandon Jenkins, Benjamin Miller, Kenny Shin

Categories: Real Estate Investment, Crowdfunding, Financial Services

Founded: January, 2011, Seed funding in 2011

Fundrise Management Team

Real Estate Crowdsource Investing

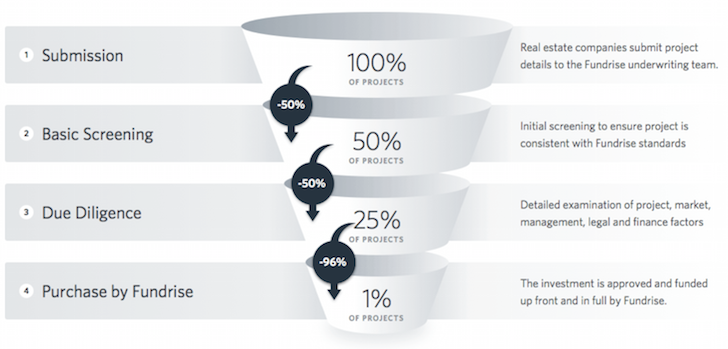

One of the most efficient ways to invest in real estate around the country is through real estate crowdsourcing. Instead of flying around the country to kick some sheetrock, one can simply invest as little as $1,000 – $5,000 in various pre-vetted deals on Fundrise’s platform. Fundrise only chooses the best operators based on their careful vetting process. From there, the individual can analyze each potential deal to fit what suits them best.

What’s awesome about Fundrise is that it also has eREITs to invest in by region for non-accredited investors. Each eREIT (West, Midland, East Coast, Growth, Income) is open for all investors where there is supply. An investor can simply ride the geographic/strategic decisions the eREIT manager chooses to make a potentially healthy 8% – 16% return based on historical performance.

Here are three examples of Fundrise’s eREITs. I’m partial to the Heartland eREIT due to the President’s focus to bring jobs back to Middle America. Further, with the new tax plan for 2018 limiting state and property deductions to $10,000 and mortgage interest deduction to mortgages of $750,000 from $1,000,000 in the past, expensive coastal city real estate markets are going to be hurt at the margin.

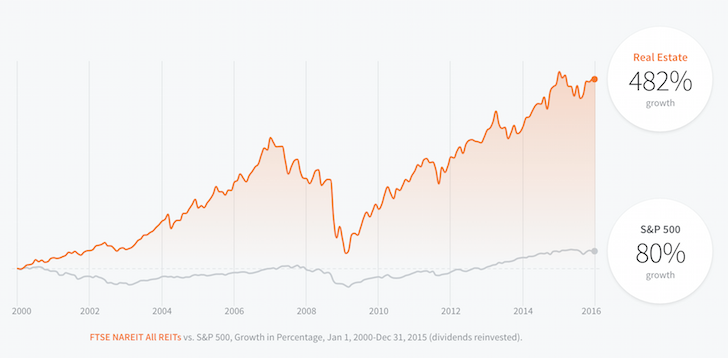

Real Estate Versus Equities Performance

The following chart compares the performance between real estate and the S&P 500. I’m surprised to see such massive outperformance by the FTSE NAREIT ALL REITs asset class. But I guess it makes sense because after the NASDAQ bubble burst in March 2000, real estate started taking off partly because the Fed aggressively lowered interest rates, and partly because equity investors looked at hard assets to park their money.

I’m in the camp that interest rates will stay lower for longer. As a result, I continue to see real estate as an attractive long-term asset class given real estate provides a relatively good yield relative to the 10-year government bond yield at ~2.5%.

Real Estate Investing Sweet Spot

Historically, there’s data that shows investors with roughly 20% allocated to real estate have outperformed those who only own stocks and bonds. The 20% real estate model was made famous by the ~$25B Yale Endowment, which outperformed traditional allocations 22.6% annually for decades by investing at least 20% of its portfolio in real estate.

However, in the past, the best private real estate opportunities require minimums of $100,000 or more, making them inaccessible unless you’re very wealthy. The only other option is to go through middlemen who charge high fees, thereby negatively impacting returns. This is where Fundrise and their technology comes in because their investment minimum can be as low as $1,000 for some deals.

Below is a chart highlighting the different sized real estate markets. You and I can’t buy trophy properties like the Empire State Building because these properties are just too large and expensive. You and I can buy fixer uppers to make some sweat equity. I did so in 2014 by buying a panoramic ocean view property in the Golden Gate Heights neighborhood of San Francisco.

But fixers can be risky and stressful if you don’t know what you’re doing. So it seems like the Midsize market is the sweet spot for investing given less competition, a more inefficient market to exploit, and potentially higher risk-adjusted returns. This is where the real estate crowdsourcing industry currently operates.

An Easier Life

The biggest benefit of not owning physical rental property is never having to deal with people. For the most part, tenants are fine to deal with if you’ve vetted them properly. But sometimes, no matter how nice they can be on paper and in the interview, conflicts may arise.

If I can invest in real estate and make a 7% return a year, let alone a 10% – 14% annual return based on Fundrise’s previous performance, I’ll double my investment after 6-7 years. The main “drawback” to investing in REITs and real estate crowdsourcing platforms is that I can’t leverage up 5:1 like I can with a mortgage on a physical property. But sometimes, not leveraging up can save your hide, especially now that real estate prices in the coastal city markets have risen so much.

Diversify Your Investments

Less than 5% of the real estate deals shown gets through the Fundrise funnel

Everybody should seek to own their primary residence to get neutral inflation. After that, consider investing in stocks, bonds, and real estate crowdsourcing investments through a company like Fundrise. They’ve opened up new opportunities for everyday investors to gain access to properties they otherwise would not have access to in the past.

Fundrise also introduced the first low-cost private market investment portfolio. When you invest with Fundrise, your money is automatically diversified across their proprietary eREITs and eFunds, investment products specifically designed to be low-cost and tax efficient.

For those who want to diversify their investments, own an underlying hard asset, not have to deal with maintenance and tenants, and take advantage of lower valuations and higher rental yields across the country, take a look at Fundrise. It’s free to sign up and explore.