I set up my own company in 2012. After decades of working for other people I felt the time was right. I had the experience and the contacts to make it viable and I was willing to put in the monumental effort needed to embark on such a venture. It was a nerve wracking decision, but more than anything it was exciting. In April 2012 Photon Storm Ltd was incorporated and began trading.

After talking with my accountant we decided to open an HSBC Business Account here in the UK. The process was problem free. They provided me with a company debit card and standard banking services. I did my part, ensuring we were always in credit and never needing to borrow any money. My accountants looked after the paperwork, keeping everything up to date. And we’ve been profitable and maintained a healthy positive bank balance since day one.

Everything was going great until Thursday August 10th 2017. I tried to login to our internet banking to pay a freelancer and was met with this message:

At first I assumed it was just a mistake. Maybe the anti-fraud team were being a little overzealous and wanted to check some card payments? I called them immediately. After bouncing through multiple departments I finally end-up talking with HSBC Safeguarding. They tell me they can’t give any more information, cannot un-suspend the account and would need to call me the following week.

However, the alarm bells were already ringing. I knew exactly who the Safeguarding team were because I had talked to them earlier in the year after receiving their scary letter. The letter said they needed to conduct a business review or they would be forced to suspend my account. That’s not the kind of letter you ignore. So I duly responded and completed my business review with them. This was 2 months before the account was suspended, back in June.

Safeguarding is a process that HSBC is taking all of its accounts through in order to better understand how they are used. It’s the fallout of HSBC receiving a record $1.9 billion fine as a result of a US Senate ruling where they were found guilty of allowing money laundering to “drug kingpins and rogue nations”.

It involves them asking all kinds of questions related to what you do and the comings and goings on your account. Who are the people and companies paying you, and being paid by you? What work was invoice X for? Do you have any large sums of money coming in or going out? Which countries do you work with? Why do you hold the bank balance you do? and so on.

It takes around an hour and although marketed as offering me protection against financial crime, what it was really doing was checking I’m not a drug cartel or rogue nation. I am of course neither of these things, but I appreciate they had to check, so I answered every question as fully as I could. I was told that if they needed more information they would be in touch, otherwise it was all fine.

Fast forward to August 10th and clearly things are not “fine” at all.

My business earns income via two streams:

1) Game development. A client will request a game, usually as part of a marketing campaign and we build it. Sometimes we supply everything: the concept, art, coding and support. And other times the client will handle the design in-house and we provide the programming that glues it all together.

2) Our second method of income is from our open source software. We publish and maintain an HTML5 game framework called Phaser. The core library itself is completely free but we make money from the sale of plugins and books via our shop, as well as our Patreon.

All of this was explained to HSBC during our business review.

Then they drop the bombshell

So I wait patiently and anxiously for HSBC to ring. At the appointed time someone from the Safeguarding team calls and explains that they want to conduct the entire business review again, from scratch. No definitive reason was given as to why they needed to do this. It sounded like they were unhappy with the level of questioning asked the first time around.

Frustrated but wanting to resolve this as quickly as possible I comply and go through the entire review again, answering in even more detail than before, to make it painfully clear what we do and where our money comes from.

The second review ends. I’m told that the information is to be sent off to another department who check it, and if they want more details they’ll “be in touch”. I’d heard this same line before, back in June and I no longer trusted them. I begin calling every day to check on progress. It starts taking up to 40 minutes to get through. Clearly they’re dealing with a lot more customers now. Every time they tell me the same thing, that the “other” department hasn’t looked at it yet, but they’ll be in touch if they need more information and “your account will remain suspended in the meantime”.

No-one will admit it’s a mistake that this was even happening. No-one will tell me why they didn’t ever call to ask for more details back in June after the first review. No-one will tell me why they suspended the account without even notifying me in writing. I’ve been wrongfully lumped in with all of those who perhaps didn’t reply to their initial warnings and I have to just sit and wait it out. I’ve filed complaints via their official channels which have so far elicited no response at all.

This has been going on for weeks. At the time of writing our account has been suspended for nearly 1 month and I’m still no closer to understanding how much longer it will be.

Also, it appears I am not alone:

One part of the above article in particular stood out to me:

“Inhibiting an account is always a last resort, so to get to that stage we will have done everything we can to contact the customer and get the information we need,” said Amanda Murphy, head of commercial banking for HSBC UK.

Like hell they did.

Because our account is suspended all direct debits linked to it automatically fail. All services that store our debit card and try to charge it also fail. We are unable to transfer any money out of our business account, which means we cannot pay ourselves, our freelancers, or any of our suppliers.

Like most people I’ve been in the situation before where I didn’t have much money. Running on fumes come the end of the month, eagerly awaiting my salary. But I have never been in the situation where I have all the money I need, that I spent years working hard to earn and save, but cannot access a penny of it.

It’s a uniquely frustrating feeling being this powerless.

Everything starts to break

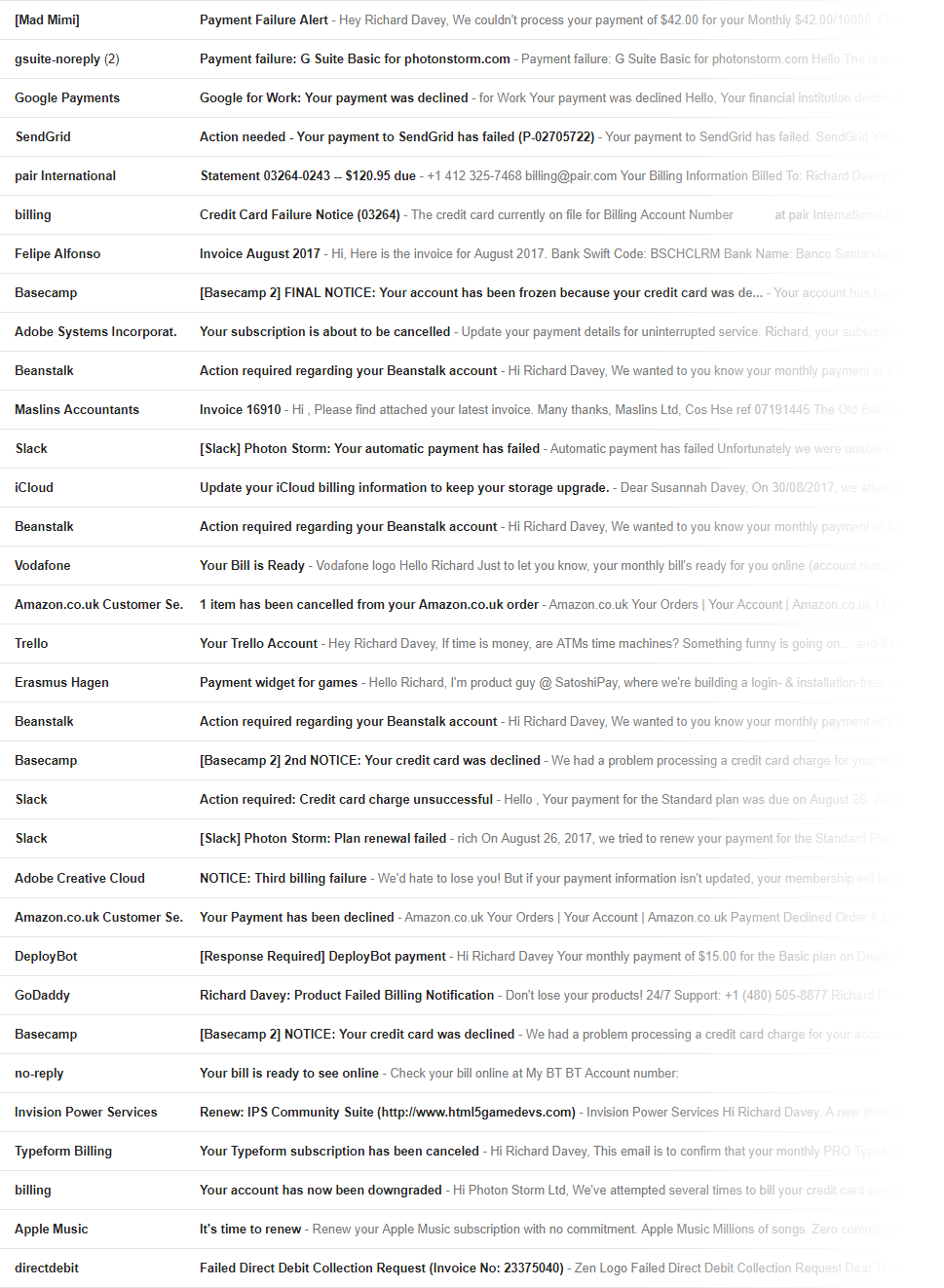

An interesting thing happens when you run a business that relies on internet services to operate but have no means of paying them: It starts to break. Not all at once, but in small pieces. Like a stress fracture that grows bigger over time. Here is a small section of my inbox to give you an idea of the scale of the problem after a few weeks:

The first to die was GitHub. We have a bunch of private repositories and if you don’t pay your GitHub bill they eventually close access to the private repos until the account is settled. We store our entire web site in a private repo, so we had to pull some funds from our rapidly dwindling personal account to cover it, otherwise we literally couldn’t update our site.

Then Apple failed. This was a strange one — it appears you actually need a valid payment card associated with your Apple account or you cannot download free apps or update existing ones. Every time you try it just asks you to re-enter payment details. Not a show-stopper, but frustrating all the same.

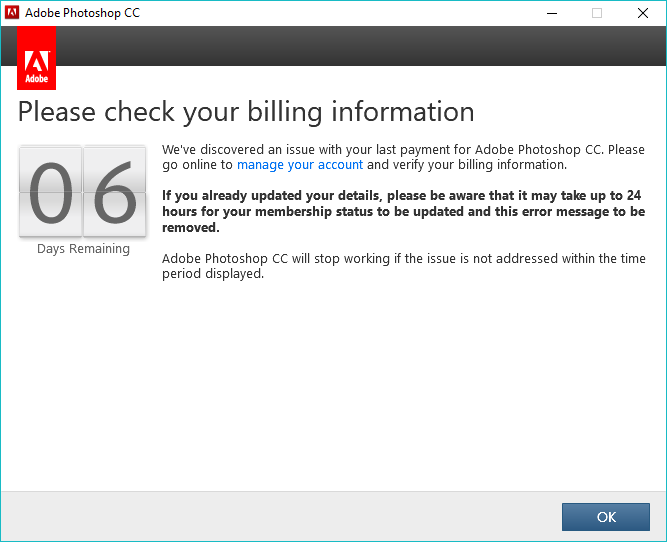

And so it carries on. Photoshop, Trello, Beanstalk, Slack, GoDaddy, Basecamp, SendGrid — you name it, when the bill is past due, they all eventually fail. Some of them fail more gracefully than others. Adobe at least give you 30 days to resolve the issue before turning your software off. SendGrid give you just 48 hours to “avoid the suspension and / or limitation of your SendGrid services.”.

I don’t blame any of these organisations for doing this. I have no personal relationship with them, they don’t know me from Adam. I’m just another failed bank card to them, draining their systems. They don’t understand my situation and to be fair they don’t have to care even if they did.

My web server is hosted with UK Fast, who I do have a client relationship with and was able to explain what is happening to them. So far they have been excellent and it’s only because of them that my web site is even still running and generating my only source of income right now.

But bigger services will start to fail soon. Broadband, the phone line, Vodafone, the water and electricity providers that supply the office I work from. Even the office rent is due next month. Where possible I’ve told everyone I can what is going on but it can’t last for ever.

Most harrowing of all I’ve been unable to pay a member of staff what he is owed. I pushed a personal credit card to the limit just to send him some money via TransferWise but he has had to find other employment while this mess gets sorted out. I don’t blame him at all, I would do the same thing in his situation as I’ve a mortgage to pay, a family to feed and bills too. It’s incredibly frustrating knowing the money I need to solve all of this is right there, but untouchable.

Hints and Tips for your bank screwing up

I figured that at the very least I would try and offer some words of advice based on the back of what’s happening right now:

- Don’t bank with HSBC. If you’re about to start a small business, think twice. The banking service is perfectly fine, but when something out of the ordinary happens they move like dinosaurs.

- Don’t keep all your business funds with the same bank. This one is a lot harder to arrange and can complicate your accounting, but I’d say it’s worth the hassle. Make sure you’ve enough funds set-aside in an entirely separate account, with an entirely different institution, to cover what you need for a month or more. I wish I had.

- If you can pay for an internet service for a year, do so. Most services offer discounts if you pre-pay anyway, so it saves money, but it would also protect you against temporary payment problems in the future, unless of course you’re incredibly unlucky and they land at the same time your yearly payment is due. Our DropBox account was paid for the year thankfully, so our files remained intact.

- If you don’t need a service, cancel it, or do it yourself. When everything started failing I was surprised to see a couple of subscriptions I had that weren’t even needed any longer. The payments were quite tiny but I didn’t need to be spending the money at all, so at least I got to cancel those. It’s also made me question the need for a couple of services I have that I could spend some time and do myself locally (git repo hosting for private projects for a single team is a good example of this)

- Keep control of your DNS with a provider separate to your web host. Although it’s a horrendous situation to be in, should you be forced into it at least you can update your DNS to point to a new host. This isn’t always possible if they manage DNS for you as well, but if your business relies on your site for income it’s a safe thing to do.

- Be able to redirect payments to another bank account. This was an absolute life saver for me. All of our shop sales are handled via Gumroadand we were able to change the account they pay in to each week away from the business one and into our personal one. It’s going to be a nightmare to unpick when this mess is over, but it was that or don’t buy any food. The groceries won. We also get money from advertising, affiliates and Patreon into our PayPal account. A massive shout-out to PayPal for being so excellent. They were able to issue us with a MasterCard (linked to our PayPal balance, not a credit card) and allow us to transfer money into our personal account, instead of the business one. This was quite literally the only way we managed to pay our mortgage this month. PayPal, thank you. Your support was fantastic. I only wish HSBC were more like you.

- If you run a small business ask yourself this: What would happen if your account was frozen and you couldn’t access a single penny in it? How would you cope? It’s an unusual predicament, but clearly not a rare one.

What next?

I really don’t know. Our account is still suspended. HSBC are still a brick wall of silence. The only income we have at the moment is from shop sales, Patreonand donations. It’s barely enough to cover our living costs, but thanks to some superb thriftiness from my wife, we’re making it work. Just. We are literally being saved by the income from our open source project, but unless HSBC hurry up, it won’t be enough to save my company as well.

I cannot wait for this nightmare to be over. Once it is, I cannot wait to transfer my business away from HSBC. Assuming I still have one left to transfer.

Until then, opening Photoshop this morning summed it up well:

Update: 4th September — HSBC just called me!

It has been an insane few hours since I posted this article. Thank you to everyone who commented or retweeted. It has literally exploded on twitter, is the top story on Hacker News, etc. I think the injustice of it all struck a chord.

And, get this… HSBC called me. A very apologetic lady from their complaints department said they hadn’t yet investigated the cause of the account suspension, but that it had been removed and everything was running normally now. Even though I’ve been telling them for weeks it was a mistake and met a stone-wall at every turn. I guess all it took was hundreds of thousands of outraged tweets?

So part of me is incredibly happy this is close to over. The other part of me is unbelievably furious it took a social outcry to fix it. The number of companies I have heard from who have experienced the exact same thing is staggering.

To those who donated to me — thank you! I will contact you all to offer your donation back if you would like it. The purpose of my article was never about making money, only about getting my own back again. Please give me a few days to sort this out, my inbox has exploded, but at least I can pay the bill for it now. I’ll update this article as I learn more from the bank.